This blog is a little more special for me.

Because this tells the very first purchase I had in the stock market.

Yes, that was the time when I was just a little kid wandering in a wide vast field.

Just like starting anew in anything, my clueless personality made all the moves for me.

All I had to hold on was my mustard dream of financial freedom and the belief that stock investing can be a path for that dream. I managed to cut the chase, and applied for an account.

Philstocks was my first online broker, precisely because they required only 5000 initial deposit to actually start trading. (But now I discovered that you can start opening your trading account just by opening a bank account, like in the case of brokers BPI Trade and FirstMetroSec).

Minimum investment required was 5000, but I put down 10k just to put a front that I have more than that. The lady in charge gracefully accepted it after examining my forms, then handed me a receipt, which was also the highest-valued receipt I received ever since.

With my humble 10k initial investment, I was too excited to buy a company share and brand myself a part-owner of a giant company. Hard-core traders would laugh on me for that, but I was already more than happy just giving it a try.

The moment I received my account details, I made my first order.

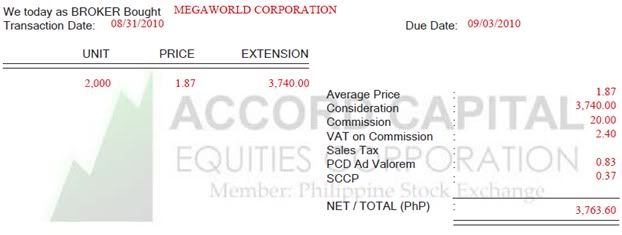

And my first stock purchase: 2000 shares of Megaworld Corporation (stock symbol MEG) at 1.87 per share. Wheee!