In my last blog - Are you financially better off now than last year? (with lots of helpful tips for an abundant new year), I shared that one of the very basic reasons why it's important to invest is to beat the effect of inflation.

But what exactly is inflation? How does it erode our money's purchasing power?

In below article, you'll see in very simple numbers how inflation can make you an automatic loser if you're one of those who are ignorant about it. Find out what you can do about it.

|

| Photo credit: Are you also a victim of inflation? |

***

SIMPLE MATH TO WEALTH BUILDING by Lyndon Malanog

We can find a lot of numbers in the Bible starting from how God created the world. God also gave us the formula for savings when He instructed Joseph the Dreamer to save one-fifth of the produce of the Land of Egypt during the seven plenteous years so that Egypt will not perish in the next seven years of famine to come (Genesis 41:34-36). In our Light of Jesus community, Bro Bo teaches us how to save and invest using our “Prosperity Formula” which is:

100 percent Income – 10 percent Tithes – 20 percent Savings & Investments = 70 percent Expenses.

This means that we have to adjust our lifestyle to the 70 percent of our income if we want to build wealth. But for this article, let me focus on the 20 percent savings and how arithmetic (adding, subtracting, multiplying and dividing) will influence its future value whether it be growing or losing.

Let’s say that your 20 percent savings is 10,000.00 pesos and you decided to put it in a Time Deposit Account which is roughly 1.75 percent PA (per annum) as of today. Using arithmetic, the computation would go like this:

Multiplying 1.75 percent PA of Time Deposit Rate to 10,000 will give us 175. Adding 175 to the original amount of 10,000 will give us a Gross Amount after a year of 10,175.

Almost all income from interest rates are taxable. So, applying 20 percent withholding tax to the income which is 175 will give us 35 and subtracting 35 from the gross amount of 10,175 will give us the Net Amount after tax of 10,140.

We are not done yet because we haven’t included the effect of Inflation. Inflation is not the tire pressure of our car but it’s the rising prices of commodities. Inflation on the average ranges from 3-5 percent PA. Using a 5 percent Inflation PA and multiplying 5 percent to the Net Amount after tax which is 10,140 will give us 507. Subtracting 507 from the Net Amount after tax of 10,140 will give us the Net amount after a year which is 9,633.

Surprisingly, the resulting amount is even lower than the original amount. This computation may be so simple to a lot of you but I have met thousands of people who are not really aware that their money is not really growing. It is indicated below as follows:

10,000 Original amount

+ 175 (1.75 percent Time Deposit PA)

10,175 Gross Amount after a year

- 35 (20 percent of 175, withholding tax)

10,140 Net Amount after tax

- 507 (5 percent of 10,140, average inflation/year)

9, 633 Net amount after a year

The net amount shows that your savings is actually losing value year after year. Subtracting the net amount from the original amount after a year will give us the amount we lost.

10,000 Original amount

- 9,633 Net amount after a year

367 Amount we lost

Dividing 367 which is the amount we lost by 365 days in a year will give us…

= 367 Amount we lost / 365 days in a year

= 1.0054/day rate of losing value

This Simple Math or Arithmetic tells us that our original amount is losing at the rate of 1.0054/day. This also tells us that we need to put our savings and investments in an investment instrument that will outpace the effect of taxes and inflation.

(Better way to explain inflation is this:You initially had 10,000 pesos, with that you can buy (something) Nagtipid ka, nagtiis ka at nilagay mo sa bank time deposit account yung 10,000 mo. Kumita ka ng 140 pesos so may 10,140 net of taxes ka.

Kaso, yung dating (bagay) na 10,000 pesos, nagkakahalaga na ngayon ng 10,500 pesos -- yung dating kaya mong bilhin, ngayon hindi mo na kaya.

Nagtiis ka nga, yun pala, mas ok kung binili mo na lang yung gusto mo. Thanks to Aya Laraya for this note).

We are now in the Information Age and not in the Industrial Age. Financial Literacy is vital to keep up with the fast changing world of numbers. Make time to learn by attending our seminars but if you think financial literacy is a waste of time, try losing the value of your money year after year from your savings and investments!

Remember, we are only stewards of God’s wealth (Deuteronomy 8:18). Learn to grow what is entrusted to you (Matthew 25:29).

Happy investing.

***

PS: The above piece is a short section of a sample Wealth Strategy article of Truly Rich Club from Lyndon Malanog.

Lyndon Malanog is an Entrepreneur and the Financial Coach of Bo Sanchez, Inc.. He continuously gives “Financial Discipline and Wealth Management” seminars to companies and groups as part of his noble mission and advocacy of educating people.

Meet Lyndon in person in our Practical Money Management + How to Win in Philippine Stock Market Seminar! this coming January 25 at Max's, Cubao!

Get also an exclusive bonus access to our Investing in Philippines Private Mastery Group to help you maximize your learning from the seminar.

Click here for more details.

Seats are running out fast so invest in YOURSELF now and get the Early Bird fee of

Click here for more details.

PS2: Hey, SAVING is a good habit (and a MUST at that), but you must obviously never stop there. To add, growing your wealth should be a PROCESS. It's ideal to observe this process because failure to do so can be a big risk in your financial life. One surprise strike and you're Janjanjanjan... TUMBA.

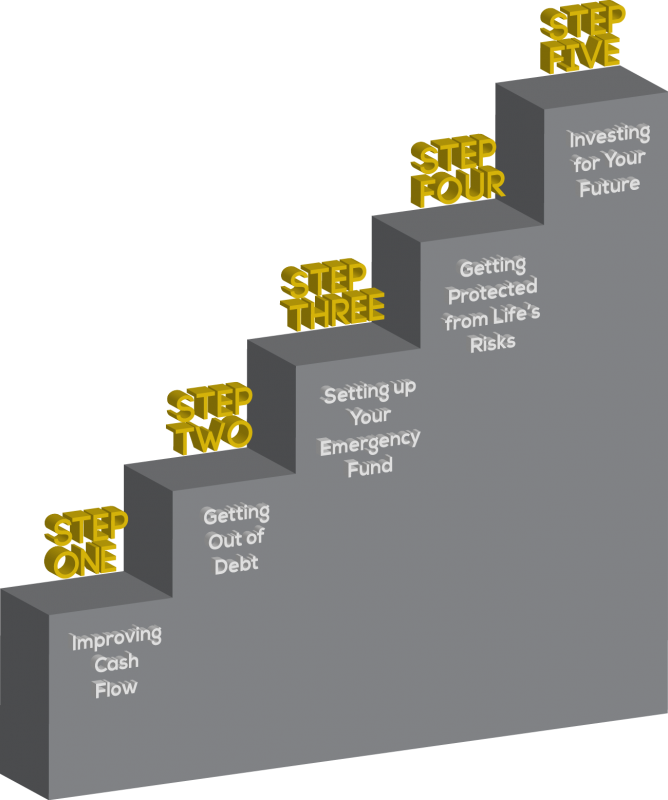

In Randell Tiongson's book No-nonsense Personal Finance, he proposes to follow below sequence of steps.

You can watch this ANC's free video of him discussing it in more details, but it basically means that BEFORE you invest, you need to have your cash flow/income source stabilized, debts eliminated, emergency fund accumulated, protection secured, and then that's the only time you go investing. Simple concept but often overlooked. A good reminders it to remember that the goal is not really to have big chunks of money, but to achieve our ultimate life goals with enough money in our hands. Millions can easily fade away even with just one unfortunate life tragedy, so better to have a process protect you.

PS3: Have a SUPPORT system for your investment journey, and be guided in every step of the way with Truly Rich Club.

Truly Rich Club is a membership Club that Bo Sanchez had created to help people achieve Financial Wealth and Spiritual Abundance. It provides its private members with the right tools, principles, and strategies to grow their mindset and thinking and, in turn, their financial and spiritual life.

To get to know more about the club, its current recommendations and other wealth-building lessons, click here - Easy Investing the Truly Rich Club way!

PS4: On the recent facebook post about starting early, one person shared:

" I am now 24yo. When I first learned about investing in the stock market, I was like, "meron pa lang ganito? Ba't ngayon ko lang nalaman to?" At the age of 21, feel ko late na ako sa pagdiscover on those stuffs. I thank God na naimbento ang internet at nagagawa ko ang research ko about this. Don't mind those people. Buti ka pa you are free to put any amount of your money in this very lucrative investment opportunity. Others are willing but due to them being the breadwinner of their family, they can just start at the bare minimum."

And that my friend reminds us of the beauty of starting as early as you can (following the process of course).

Join us in our upcoming seminar and learn more how you can take a proactive approach in securing and improving your financial life starting this year and find out practical strategies in growing your wealth in the stock market.

Seats are running out fast so invest in YOURSELF now and get the Early Bird fee of

Click here for more details.

No comments:

Post a Comment